It’s nice to see that Zillow recently saw fit to proclaim, in its 2022 real estate market predictions, that “the Sun Belt dominates Zillow’s list of hottest housing markets for the second year in a row.” At the top of that list? Tampa and Jacksonville.

Now, those of us who live in Florida have always known it’s a natural real estate, er…hot spot! But, especially after weeks and months of reading the doom and gloom of the impending decline of the refinance spike; rise of interest rates and shortage of inventory, it’s nice to put it all into perspective.

While it’s easy enough to aggregate numbers from numerous local markets to create some national numbers, there’s no true national market. Just a collection of local markets. So saying many trends will impact each market equally is much more often than not false. Will interest rates rise this year? Probably. But how much will they rise; how long will the rise take to impact each market and to what degree? Let’s not forget, home values have soared over the past three years. It’s not all that apparent that they will suddenly crash. Will appreciation slow? Yes. Are declining appreciation and depreciation the same thing? Absolutely not. In fact, the same Zillow forecast suggests the nation’s top 50 markets are expected to “grow healthily in 2022.” That doesn’t sound like a year of doom and gloom to us.

Now, back to Florida, where the vast majority of Hillsborough Title’s clients, partners and friends live and work. The same forces that drove our largest markets to jaw-dropping growth in 2020 and 2021 are still in place. Home values will likely still grow. Inventory is still moving quickly, indicating demand remands high. And employment and population indicators suggest Florida’s top markets are still home to motivated, capable buyers with confidence in the job market and their earning potential. So whether the Fed raises the primary national rates by a quarter of a percent or .000001 percent (and believe us, it won’t be raising it enough to disrupt the economy dramatically in an election year), odds are that, if you have property or clients with property in Tampa or Jacksonville (or Miami, or Orlando, or Gainesville…), it will be another productive year for our friends in the real estate business.

We’re ready for the volume here at Hillsborough Title. And we’ve only continued to work at streamlining our processes to create the smoothest, fastest, most tension-free closings you could ask for in a purchase environment. Then again, we’re proud of the places we live and work, and we never bet against them. So Zillow’s just telling us what we already knew!

Take the FEAR out of FIRPTA

FIRPTA is an acronym for the FOREIGN INVESTMENT IN REAL PROPERTY ACT of 1980. We know FIRPTA sounds crazy, and it does have a bunch of rules. But the idea behind it is simple – when buying a house that is owned by a foreign party, the title company must withhold a portion of the sale to make sure they pay taxes and it’s up to the BUYER to report the sale to the IRS!

Sounds complicated, we know… so here are 5 Facts to take the FEAR out of FIRPTA

FACT 1: WHO IS FIRPTA FOR?

The first thing to know is that FIRPTA only applies to buyers that are buying from a seller who is not a US Citizen/Resident Alien. There are several identifying factors for a foreign person or company, which the title company will discuss with the seller. If the seller is a foreign person or company, then there may be a portion of the proceeds withheld from closing. The seller will apply for a TIN number before the sale by filling out the W-7 application, if it’s the first time selling a property in the US.

FACT 2: CAN THE SELLER BE EXEMPT?

Yes! If it is a home with a sales price under $300,000 and the buyer intends to occupy the new home as their primary residence for most of the year, over the next two year period of time, the property is entirely exempt from the withholding. The buyer will be required to sign an agreement to confirm their intent to reside. This fact means for some people, FIRPTA never comes into play – but there’s still some paperwork you’ll need the parties to sign at closing.

FACT 3: HOW MUCH IS WITHHELD?

IF the sales price is over $300,000 to $1,000,000, the required withholding is 15% regardless if the buyers intends to occupy the property full time. There are some other rules that can make the withholding % increase or decrease, however, those are more rare.

FACT 4: What about a SHORT SALE?

Unfortunately for the seller, sometimes the sold home is worth less than the amount owed, but the FIRPTA requirements STILL come into play.

FACT 5: WE DO IT ALL FOR YOU!

The best part is when using ANY Florida Agency Network branded title company, we’ve got you covered when it comes to FIRPTA. We will discuss what is needed, based on the particulars for the parties and transaction and also have CPA’s that we can refer to, if needed.

To download more information about FIRPTA download our PDF here or call any of our locations.

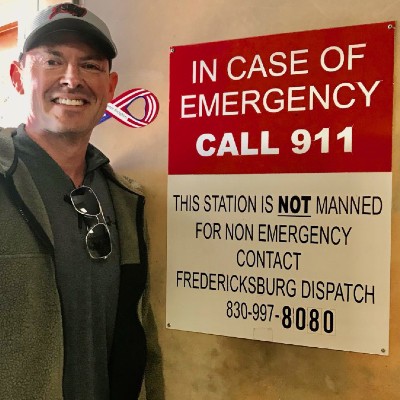

Aaron Davis earned a new nickname this week, the "Tampa Chainsaw Man", and for good reason. He saw the devastation throughout Texas, and after traveling to the region, donating and raising funds for local Texas charities, he asked what else he could do. That's when they put a chainsaw in his hand. With his Bucs hat proudly on his head, he started removing trees and other debris to further relief efforts and lend a helping hand.

TEXAS (People.Com) - Aaron Davis flew from Tampa, Florida, to Austin, Texas, on Friday — because he wanted to help people affected by the snow and ice storm.

"I just felt incredibly guilty sitting down in Tampa, Florida, in the sunshine watching the rest of the country suffer," Davis, 45, tells PEOPLE. "I've weathered many storms in my life in Florida, the hurricane capital of the world."

During the last Florida hurricane, he bought and delivered generators to people in need. "I just try to step up and do what I can," he says.

A business owner (his company does remote real estate closings), Davis told his staff he was taking a month off to volunteer in Texas. "I felt the need to be feet on the ground in Texas to help out however I could," he says..... Read full article.